Mungerism

The manual to live a life.

By Prajwal Basnet | Dec 19 2022 | 11 minute read

Introduction

I have read ton of books from great authors, and of all the books - "Poor Charlie's Almanack: The Wit and Wisdom of Charles T. Munger" is my favorite. A book that has large impact on how i think and approach problems and this book is closest thing to a life manual i have found so far.

This book is the collection of Charlie munger advice given over 30 years which covers all sorts of things from introduction of mental models, to an cognitive biases(psychological tendencies), investing principles and his extra ordinary work ethic -the twin font of his amazing sucess- through his approach to life, learning , decision making and investing.

In this blog, I have attempted to compile the philosophy of one of the great minds of 20th century. I wish you have good reading and an appreciation of the brightness and dry humor that those of us who know Charlie Munger have come to treasure and expect from him.

Who is charlie munger?

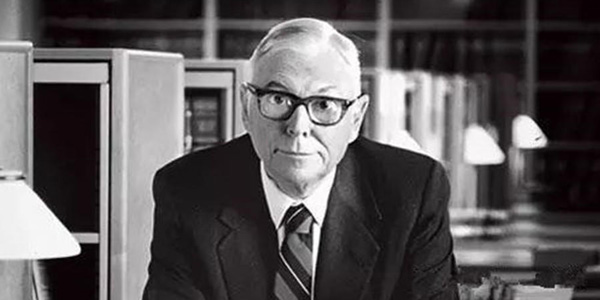

Charlie munger is an American billionaire investor, businessman and former real estate attorney. He is best known for quick wit and vice chairperson of Berkshire Hathaway - warren buffet controlled conglomerate.

Charlie munger Advice to young people

Charlie munger has been absolutely treasures to the young people by sharing his nearly 100 year of wisdom. when writing this section, I wrestled on which advice to write so i have decided to reference his mental models, psychology tendencies and quotes at the bottom of the page to those who are want to follow munger and his philosophy.

I have listed his few indespensable wisdom below:

- Spend each day trying to be little wiser than you were when you woke up: He suggests to learn something daily and at the end of the day - if you live long enough- like most people you will get what you deserve.

- Don't do cocaine. Don't race trains and avoid AIDS situation: He meant to say that avoid stupid things by inversion. He puts his best when he quotes "If i know where i am going to die, i will never go there." so he advocates to use inversion. For example: Instead of asking "how do I become happy?", one should be asking "How do i become depressed?" which might be due to following reason:

- No exercise.

- Poor sleep.

- Lack of Balance diet.

- Meaningless work.

- Don't work for anyone you don't respect and admire.

- Have a low expectation: According to munger, that unrealistic expectations assures misery. Therefore, only way to avoid disappointment is to expect it. He posit that the number one rule to be happy is to lower the expectation.

Munger Approach to Life, Learning and Decision making

Take a simple idea and take it seriously. " ~ charlie munger

Charlie employs multiple mental model - framework to his decision making - from traditional disciplines like history, psychology, physics, mathmatics, engineering, biology, chemistry , economics etc. Charlie quotes the idea of Julian Huxley that "Life is just one damn relatedness after another", so he put forward that to overcome relatedness and its affect, one must master big ideas from variety of disciplines and use them routinely - all of them not just few. The core of the idea, here, is that most people are trained in one model - for example, computer - and try to solve problem in only one way. To him this is, man with an hammer syndrome( for whom every problem looks like nail). He, thus, recommend to be a man with a swiss army knife by utilizing the model inhertied from different discipline. His important model includes compound interest/statistics from mathmatics, Darwinian synthesis model from biology, cognitive biases from psychology, redundant/breakpoint from engineering etc.

Perhaps the most valuable result of education is the ability to make yourself do the things you have to do, when it ought to be done. ~ Thomas Henry Huxley

Charlie munger on Making Friends and choosing life patner

Charlie tells when you are trying to learn the concepts of something, it will be better if you tie them with the works and personaility of who developed them. He says anyone can be friend with greatest thinker by reading their books and other materials. For example, you will learn economics better if you make friends with Adam smith. Thus, he posist on making friends with right people -even with eminent dead- with a right idea rather than just going through concept.

On chosing Life patner, He is heavily influced from Benjamin Franklin (founding father of USA) who had wrote a letter on chossing life patner which happend to be censored by USA due to its licentious content, but thanks to the internet you can read from this Link . Likewise, Charlie reccomends to Look for someone who is both smarter and wiser than you and ask him/her not to flaunt his superiority so that you can publicly praise thoughts that arise from him/her. moreover, He suggests to seek gorgerous soul who will never second guess or sulk you in expensive mistake and most importantly recommends to lower the expectation.

Charlie munger on philantrophy

Indepedent is the end that wealth serves to you, not the other way around. ~ Charlie munger

Charlie admired the trait of his role models like, Benjamin Franklin, Andrew Carnigie, John D. Rockefeller who used their self made wealth to achieve financial freedom, so that they could concerntrate on social improvement by donating on education, churches etc. Thus, later in his life after achieving financial freedom he delivered much to civillization especially in education.

Charlie posist young people should focus on work that should provide much value to civilization rather than lucrative business like money mangament (which he himself was part) because not enough is delivered to civilization in return for what was wrestled for capitalism.

It is grand mistake to think of being great without goodness and I pronounce it as certain that there was never truly great man that was not at the same time truly virtuous. ~ Benjamin Franklin

Charlie take on Aging (inspired by cierco)

Cicero is most notably known for his govermental views during roman empire where he share his view on republican form of government. He recommended the ideal government is formed by an equal balancing and blending" of monarchy, democracy, and aristocracy - which is used today. However, we are not going to learn about his government views instead we will share his view on aging.

Cicero argue against early retirement. He cites the moral idea of Pythagoras that "no man should quit his post but at the command of his General; that is, of God himself." He also believes in self improvement and quotes: "Daily learning something, he grew old. Cicero points out how silly it is to complain of reaching old age. And, he posists that if one live right, the inferior part of life is early part.

The most celebrated passage in de senectute:

"The best armor of old age is well spent life preceding it; a Life employed in the Pursuit of useful Knowledge, in honourable Actions and the Practice of Virtue; in which he who labours to improve himself from his Youth, will in Age reap the happiest Fruits of them; not only because these never leave a Man, nor even in the extreamest Old Age; but because a Conscience bearing Witness that our Life was well-spent, together with the Remembrance of past good Actions, yields an unspeakable Comfort to the Soul "

Now, the question arises, does the prescription of cicero on self help and aging really work?

Intrestingly, Ben Franklin, founding father of usa, who was the first publisher of cicero book has lived a very long life (84 years) and left behind one of the most constructive and happy life despite many disadvantages like medical facilities. Similarly, Warren Buffet, and charlie munger who have followed almost every prescription of cierco have no plans retiring from Berkshire Hathaway, despite being 92 and 98 years old respectively. They have been doing their work so joyously while showing phenomenal track record.

Charlie munger on Honesty

Honesty is not the best moral, it is the best policy.

Munger strongly advocates on Honesty and integrity. He quotes "Doing the right things pay big dividend both personally and professionally". He belives honesty pay more in long term than by lying, cheating and stealing. He opposes the maxim "Everything which is not forbidden is allowed" and believe that there should be huge gap between what you are willing to do and what you are allowed to do without significant risk. For example: when his friend was about to sell half of his venture at a fair value of 130k, charlie corrected with 230k.

If you start early trying to have a perfect track record in one simple thing like honesty, you're well on your way to sucess in this world." ~ charlie munger

Munger approach to Business Analysis and Assesment.

Charlie munger has his own way of evaluating the business. According to him, he uses the comprehensive analysis of the company financials as well as the ecosystem of the industry supported by his models, intellect, temparent and decades of experience. He connects his multiple mental models(big disciplines) to form a sound reason. Also, He puts forth the idea of relying on his fundamental guiding principles which are prepration, patience,discipline and being rational instead of group dynamics, popular wisdoms("this time it is different") etc. Finally, He recommends to use checklist for almost everything -including investment.

Firstly, He ,like Warren Buffet, advocates for the focused portfolio because they belive sucessful investment boils down to only few investment oppurtunities. He ,in his vertible wisdom, puts forth the concept of circle of competence. To explain his philosophy, Buffet/Munger use baseball analogy to hit only in the sweet sopt because reaching for worst spot will reduce their chance of sucess. Accordingly, In investing, he recommends to bet heavy in their fat pitch- when odds are in favor- and hold the position for very long time. He cites its benifts like tax advantage, free from nonsense etc . nevertheless, opposite problem is equally harmful: when one discovers a fat pitch but are unable to swing with full weight of capital.

The big money is not in buying or selling but in waiting ~ Jesse Livermore

secondly, he recommends a different approach: Invert. That is to focus on what not to do- instead of what to do. He invokes the famous statement - a bit cheekily perhaps- "All i want to know is where i am going to die, so I'll never go there". The reasoning being that after finding what to avoid, one can focus on important thing. Also, it uncover hidden belifs about the problem and force to think both forward and backward. For instance, say you want to keep your marriage sucessfull. Thinking forward, you will think all of the thing you could do to keep your marriage sucessful. But if you look at the problem by inversion, you will think all of the thing to make your divorce. Ideally, you'd avoid those things. similarly, In business you gain enormous advantange by eliminating the unpromising businesses.

Genius is the one who says no to 1000 things ~ steve jobs

Finally, he believes that investors should carefully utilize their own unemotional judgment of value, so he considers psychological factors of human misjudgment which help him to be rational when chosing his investment ideas.

Munger Investment Evaluation Process

First and foremost, Munger choose company that he can understand. He categories company in three ways: yes, no, too tough to understand. He looks for business that can thrive in all environment and business(or products, markets, trademarks, employees, distribution channels) that has competitive advantage.

If the companies passed this criteria then he move on to evaluate additional factors that includes regulations, labor conditions, coustomer relations, impact of changes in technology, competitive strength and vulnureabilities, pricing power, scability, environment issues and ,especially, the hidden threats. He applies equal scrutiny to financial statments which includes owners earning, inventory, working capital assets, fixed assets, intangible assets (like goodwill), liabilities as well as the assesment of current and future impact from stock options, pension plans.

Furthermore, He -notably- assesses company management to the degree they are trustworthy and owner oriented. He looks for managers who have love for their business rather than money. In addition, He, carefully, inspect how they deploy cash, compensate themselves, or persue ego centric growth for growth's sake. Instead of focusing on ceo's comitment, He rather focuses on how he/she have performed in the past - whether they have lived upto their commitment.

Finally, He seeks to calculate intrinsic value of the company taking all the aspect from his analysis. He, then, utilizes margin of safety to protect against downside risk. prior to pulling trigger, he refers as close calls which includes current price, volume, oppurtunity costs, liquid capital. Then, he bets heavy because for him small bets or initial position is an uncertainty. After that, he does not put much weight on selling those securities until and unless they passed the above criterias and do not damage their reputation.

Hardwork is essential element in tracking down and perfecting a strategy or in executing it

Charlie values

I am right you are smart and sooner or later you'll see i am right. ~ Charlie munger

- life long learning.

- intellectual curiosity.

- sobriety (state of being sober).

- avoidance of envy and resentment.

- reliability.

- preserverance (presistance in doing smt despite delay)

- learning from other mistakes.

- objectivity (not including own biases)

- willingness to test own belifs (by crushing own beloved idea).

Charlie secret of sucess in one word : rational

Conclusion

I'm glad i stumbled upon this book. Everything I have found on this book has been immensely useful with umpteen illustrations, cartoons and bold italic quotes which made the reading enjoyable. If you are looking for someone who has both humor and wisdom, you can't find better than charlie munger- and poor charlie almanack is a great place to start.