Why am i betting big on nuclear energy fuel?

Nuclear energy fuel shall revive!

By Prajwal Basnet | 17 06 2024 | 11 minute read

Introduction

Nuclear energy, in retrospect, is experiencing a renaissance. Most countries, developed or developing, are embracing nuclear energy as a clean, cheap, safe, and - most importantly, reliable(24/7) energy source. For instance, More than 20 countries at Cop 28, held last year, pledged to triple their nuclear capacity by 2050 to achieve their net zero target by 2050 -with China, India, and the US as a forerunner.

Thought process

Beside all the catalysts that i will mention in this blog, my thought process on this investment is primarily on second order effect (consequence of consequence).

You can't connect the dots looking forward; you can only connect them looking backwards. So you have to trust that the dots will somehow connect in your future." ~ steve jobs

Like in early 20, when we experienced a massive dot com bubble and evolution of tech companies. We are now experiencing -more or less, evolution of A.I technology; The stock market has never been timid to reflect this; For instance, The mag seven companies, has now market cap aggregate to GDP of europe top four largest economies.

Taking the second order effect analogy, here, the essential technology for A.I is GPU. Nvidia, a company that designs and sells GPUs, has yielded north of 650 percent since the launch of chatgpt. And, increased its revenue by more than 100 percent.

If we go further, the essential technology for GPUs is , clean and reliable, electricity. The most reliable, clean, and safe -statistically, source of energy till now is nuclear energy. In contrast, wind and solar energy has to rely on weather conditions and a large maintenance cost.

However, I could not find any big opportunity in nuclear utility companies- and stayed within my circle of competence. Albeit, Many yielded astonishing return over past year($RR, $VST,etc); I delve one step further and discovered a massive structural supply deficit - less supply more demand- in the uranium sector, excluding all the catalysts. Last year, uranium emerged as one of the top-performing commodities, but I foresee an even brighter future ahead.

Fig: My thought process

History

History doesn't repeat itself, but it often rhymes

"

Essentially, commodities are known for boom and bust. They rise sharp during the bull period (when there is less supply) and plateau during the bust period; Same happened to uranium.

During the cold war, between the Soviet and Us, there was an excess inventory of uranium where both countries were aggressive on uranium mining - and speculative boom, then by 1991 the cold war had come to end with -perhaps, most successful non-proliferation endeavour called megaton to megawatt- where they down blended nuclear weapon and used those in nuclear fuel cycle.

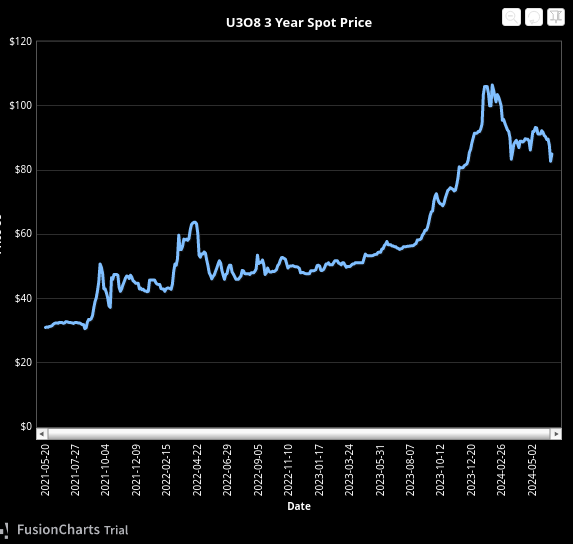

This already made excess uranium in the market, and post chernobyl disaster (1986), from 1993 to 2003, there was significant wind down on nuclear development and uranium price. However, during early 2000, the russian disarmament program was set to expire, threatening secondary supply. By 2005, commercial inventory fell by 70% and utility buyer rushed to secure uranium -aided by cigar lake flood, as a result spot price reached a high in 2007 then slumped during the global financial crisis.

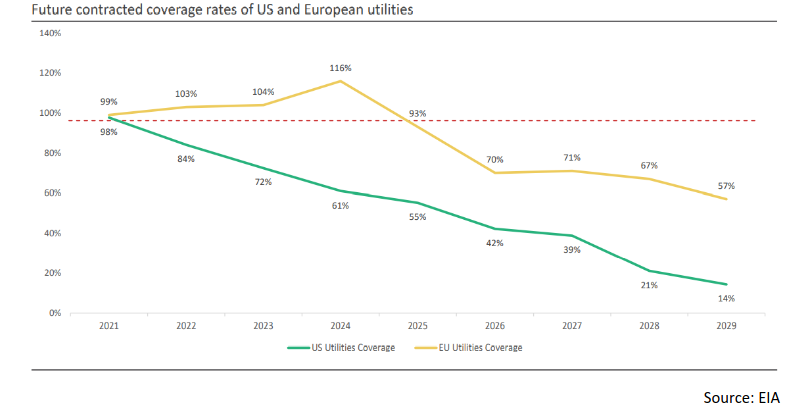

Between 2011 and 2020, the 2011 Fukushima disaster shifted the entire dynamics of the uranium market. The demand dropped substantially leading to surplus uranium for decades. Mainly, due to increased production from kazakhstan (former soviet state) to date. Between 2011 and 2019, Most of the utilities contracted from the excess secondary supply and over production -to be more concrete,over contraction, from cameco and kazatomprom.

In 2020, the uranium market reached a low point. Since then, after decades of reactors decommissioning and reversed course due to limitation of solar, wind energy, and -most importantly- shift in general public view on nuclear energy. Russian invasion of Ukraine highlighted even further tension in securing uranium (since ~40% uranium comes from kazakhstan and ~20% enriched uranium). Moreover, China's aggressive stance on development and securement of supply and usa band on russian uranium further intensified the uranium market. As a Result, uranium became one of the best performing commodities in the past few years.

Fig: Spot uranium performance over past 3 years.

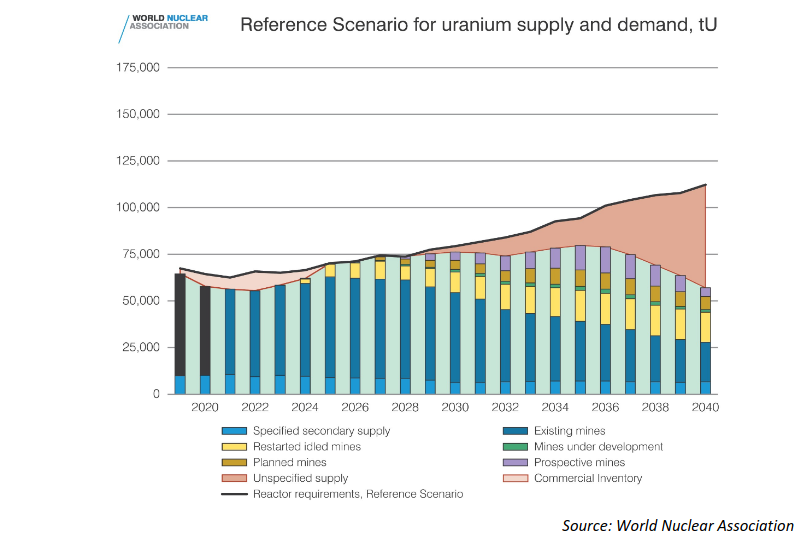

Fig: Structural supply deficit coming years.

Bull thesis

Never bet against America." ~ warren buffet

- Already Structural supply deficit, and substantial increased demand , and development on nuclear power plants for clean, and reliable energy.

- Fuel cost is not a significant cost in nuclear power plant (less than 1%), while being indispensable. Meaning, Utility is not likely to be concerned for volatality - leaving a lot room for run.

- Big tech embracing nuclear energy due to clean energy demand from data centres and A.I; For instance, constellation energy deal with microsoft to power data centre in virginia; sam altman - founder of open AI, investment on OKLO energy - nuclear company; Bill gates investment on largest nuclear power(terra power) plant in wyoming; And, all other big tech companies betting on nuclear energy to power data centres.

- US ban( bipartisan support) on russian uranium and 3.4 billion funding for domestic nuclear fuel. Us utilities need a waiver -proof they cannot secure supply domestically- to buy nuclear fuel from Russia till 2028. Afterwards, the ban will be implemented and no utility can buy nuclear fuel from russia. The ban has just been implemented in may, 2024, so no utility has requested for waiver till date based on public information.

- Possible Russia retaliation and uncertainty for both Russian fuel producer and US utility, to secure business post 2028. For utilities, funding is attached - to revive sector. And, russia fuel producer to free up from low-priced contracts fuel. Tenex force majure, within few day of ban, to us utility to get a waiver within 60 days which can take months to receive.

- Former soviet nation kazakhstan, a landlocked country, produces more than 40 percent total uranium production in the world - and passing through saint petersburg, Russia. In comparison, Saudi Arabia produces around 12 percent of world oil.

- More than 20 nations pledge to triple nuclear energy - with China, India, and Us as a forefront runner.

- Consumption of more than 50 million and production of less than 2 million by US. And, Regulatory hurdle to start new mine - ideal timeline more than 10 years currently, and delayed in production from past producing mines.

- Nuclear energy provides 20 percent of baseload energy in the USA and 10% world wide. Meaning, not going away fairly quickly - even in case of adverse events.

- General public support.

- Western countries diverting from Russia and trade bans.

- Advance act (bipartisan) bill, which is recently passed, to streamline the licensing process for the advanced reactor .

- Niger government withdrawn the permit to operate uranium mine from french company, orano. The mine was set to produce equivalent to 9Mlb which has been scrapped from future supply (larger than any us mine).

- SMR developement.

- Loss of enrichment technology, resulting in consumption of a more amount of uranium, than currently blended in russia.

Bear Thesis

- Nuclear war.

- large nuclear disaster.

- Long timeline for developing nuclear power plant from short sighted politicians.

- Politician incentives to push other clean source of energy - with less timeline for development.

- Fusion reactor might replace in more than decades - highly unlikely.

Valuation

Uranium companies have had a fairly good run since 2020. However, Overall, it has lagged behind the physical uranium price. This is considered the nature of the commodity cycle. Initially, the commodity runs up -usually after a prolonged period of deep valley, then the large cap companies followed by small cap producers then exploration companies.

The current total market capitalization of all nuclear fuel companies is only north of 60 billion - which might seem absurd in comparison to other tech companies. However, it also indicates that we might be still in early innings due to lack of uranium mining. Now, there has been a significant increase in the rush for exploration of uranium, with very few producing companies.

My view on valuation is more of an art than science, so I prefer to be vaguely right than precisely wrong. I believe long term interests of shareholders are tightly linked to the interest of customers. In our case, a clean, cheap, reliable and safe source of energy which everyone wants and overtime the demand will only increase- not decrease.

And, a stringent view on valuation - largely focused on company - present or future cashflow and number of shares outstanding - with scalability in mind. This way, it is easy to have an excellent idea of the fair value of the company. And, concentration on very few good ideas -instead of diversification. Consequently, I decided to stick to producers -mainly junior, as very few were fairly priced in that regard.

PEN (Peninsula energy)

I don't look to jump over 7-foot bars: I look around for 1-foot bars that I can step over." ~ warren buffet

My pick is Peninsula energy, with at a time 40% of portfolio @0.079; It is poised to become one of largest uranium producer in usa - with capacity to produce up to 2MLbP- either by late 2024 or early 2025. The company has licence to produce 3MLbp uranium with north of 55 million JORC recourse. In usa, The geolocial structure mostly favours conventional mining -which require mill(now only 3 permitted mill), or other technology like kinetic seperation (by $WUC) which takes long -more than 3 years, and expensive. Only few state, like wyoming, etc, is suitable for insitu mining method- which in itself is less carbon emitting, and efficient.

Albeit this has been laggard among most uranium producer, largely due to last minute dispute with agreement on toll milling followed by large financing - to construct their own headhouse; I believe at current valuation and good uranium market condition, the company is trading at attractive price.

The company is only contracted around 40 percent for 2MLbp which leaves significant room for run. And, the fact that this company is the usa producer will, in my view, eventually reiterate to industry average. In comparison, boss energy producing equivalent to 2MLB in australia, with stake on alta mess(usa), is trading at AUD 2 billion market cap.

Conclusion

To sum up, The market for uranium has never been more favourable, in any measure - in the short and long term. With many catalysts, structural supply deficit, continuous government support - to secure supply away from Russia, and to achieve net zero by development of clean, and reliable nuclear power plant; Most notably, a shift in general public view on nuclear energy.

I believe regardless of the majority country, big tech emphasising nuclear energy, A.I driving electricity demand in already increasing demand, etc. The primary thesis is yet the supply deficit in the uranium market. The investment on uranium mining will continue to increase and overtime reflect in uranium equities.